On 10 January, Royal Decree-Law 1/2023 was published in the BOE (Official Spanish State Gazette), which modifies the Social Security discounts for employment contracts and affects temporary contracts as of 1 September this year.

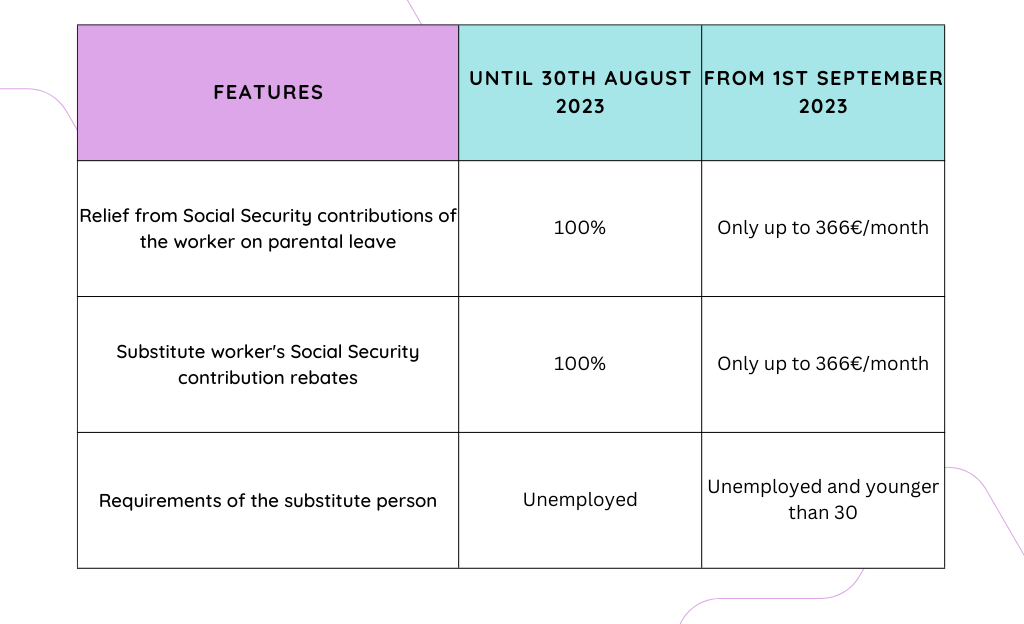

As of today, there are reductions in Social Security contributions, both for workers on maternity or paternity leave, as well as those at risk of pregnancy. There are also reductions that apply to the person who is hired as a substitute for the worker during the period of parental leave.

Furthermore, the profile of the person who can be hired to replace the worker on maternity/paternity leave has also been limited.

Below is a summary of the new conditions applicable from 1 September 2023:

– With regard to Social Security discounts for the person hired as a temporary maternity or paternity replacement contract, the company may only receive a maximum bonus of €366 per month, prorated by the number of hours contracted. This amount corresponds to the equivalent of the Minimum Interprofessional Wage. The difference in contributions corresponding to a higher salary must be paid by the hiring company.

– Likewise, the Social Security bonuses for workers on leave for childcare or pregnancy risk are also reduced to €366 per month, prorated by the number of hours contracted. As with the substitute, the difference in contributions must be paid by the hiring company.

– Finally, the profile of the worker that can be hired as a substitute in order to benefit from bonuses is limited. In contrast to the legislation applicable until now, from now on only unemployed persons under 30 years of age may be hired. Otherwise, the company will not receive any kind of bonuses.